We all want to make money. The financial markets seem to offer a huge number of opportunities to fulfil our dreams. But the single most important setup that delivers most of the time is when the fifth wave sees an extension. Believe me. Fifth wave extensions can make you rich! This article shows several examples of how this set up can be used to our benefit.

When do we say a wave is extending?

The Elliott Wave Theory says that one of the three impulse waves in a five-wave cycle will usually be extended. A wave is considered as seeing an extension when it travels an abnormal distance. Although Ralph Elliott never said this, I recommend that we consider wave 3 to be extending if it travels beyond a 161.8% projection of wave 1 by a decent margin. As for wave 5, it will be an extension when it is larger than the other two waves and travels more than 61.8% of the distance from point zero to point 3. Typically, a wave 5 extension will be 100% or more of this distance. I have covered the subject of extending fifth waves in great detail in my online Elliott Wave program.

Where do we see the opportunity to make us rich?

As explained in my Elliott Wave book “Five Waves to Financial Freedom”, when an extending wave 5 ends, we will see a swift correction down to sub wave 2 of this wave 5. So, the opportunity presents in two ways. First, we know it will be a rapid correction, which means we will not have to wait long for realizing our profits. Secondly, we know approximately how far the down move will likely travel.

How does the correction after an extending wave 5 present itself?

As I said, the easiest way to make money in any market is after a fifth wave extension. While identifying the precise end point of an extension is often a challenge, you can become quite rich by joining in once the correction starts. Typically, a market comes down to the level of 2nd wave of the just completed 5th wave (as wave ‘a’), corrects higher (as wave ‘b”) and thereafter collapses as wave ‘c’ to reach the 4th wave bottom (or lower!).

How can we use Fifth Wave Extensions to our benefit?

In the last 3-4 months, there have been innumerable instances where we have seen this happen. Regular readers of this blog have been alerted to the opportunities. Today, I am going to review those trades so that you can have a permanent record in one place of how fifth wave extensions can make you rich. Let us start with Crude Oil.

Fifth Wave Extension in Crude oil and subsequent sell off

If you had been on my mailing list before this blog was started in October, you were warned when Crude Oil was above $140 that we will go down to $50. As recently as 5th October 2008, and on this blog, you saw this post.

What happened to Crude Oil prices then?

It is hard to believe, but by 20 November 2008, a mere 6 weeks since our prior analysis, Crude Oil was trading at $52!

Crude Oil is trading close to $52 as shown in this chart. The important point to note here is, prior to this stupendous sell off, crude oil saw the end of an extended wave 5. And now it has given up all the gains of that wave 5 and is trading at the prior wave 4 level. Clearly, fifth wave extensions can make you rich!

Fifth Wave Extension in S&P500 Index and Opportunity to Make Money

Now let us look at the S&P500. On 3rd April, I emailed several of you that we could recover from the current level of 1367, but failure to stay above 1415 could trigger a sell off to around 1050. Here is the chart of April 2008, followed by the chart of 20th November 2008.

What happened to S&P 500 index!

Once again, we saw in the above case study that once the extended wave 5 was completed, the index turned around and collapsed, presenting us with a huge and easy opportunity to become rich!

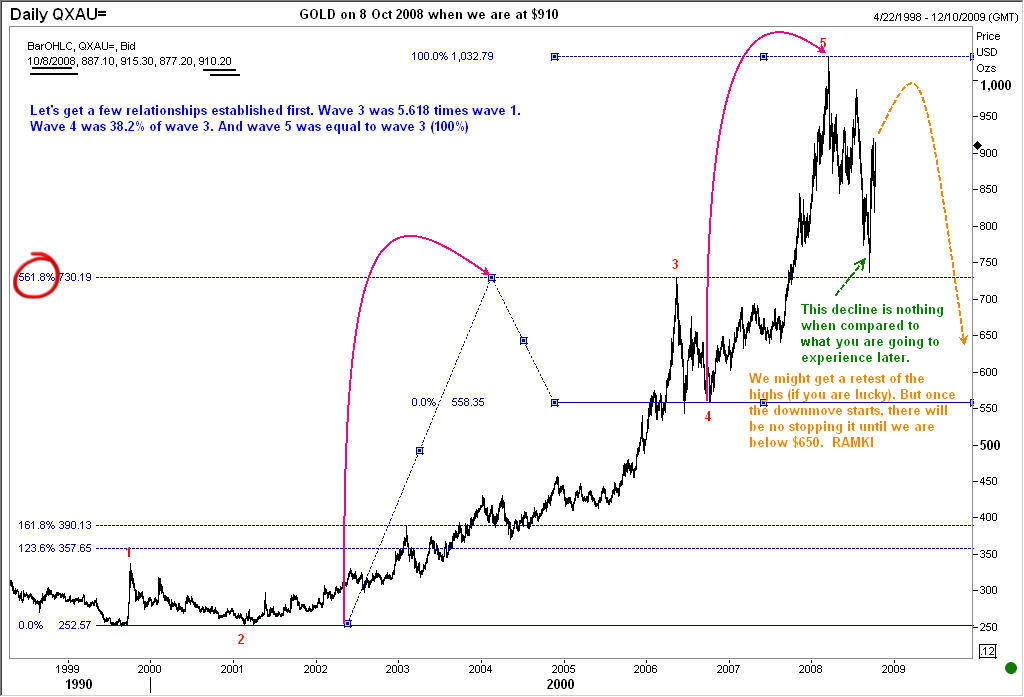

Fifth Wave Extension in Gold Was Another Opportunity to Make Money

For those of you who are interested in GOLD, this chart should open your eyes! Just a few weeks ago, on 8th October, I wrote in your favorite blog that this precious metal was ready to collapse. That was when the commodity was trading at 910, and analysts at Credit Suisse put out a bullish report on Gold. Take a look at this chart below and judge for yourself. Gold has traded well below $700 before recovering recently.

Fifth Wave Extension in Bank of America Stock Also Delivered Huge Profits

Let us look at a specific US Stock. Bank of America! This blue chip was at $26.61 back on 30th June when I alerted you that we will see it down to around $18. In fact, some of you will remember we bought the stock near there and made between 40% and 65% in a matter of days! (That was the ‘b’ wave rally). Here are two charts for your study.

The first chart was prepared in June 2008. Observe that we anticipated a wave “b” counter trend rally, but warned we will get a further sell off later.

The Bank of America chart below is from November 2008, and you can see the opportunities to make riches when we got the devastating sell off to the prior wave 4 low and below.

Wave 5 extension in the Euro that made traders rich

Next, let us take a look at the Euro dollar. The EUR/USD was trading at 1.3560 on 12th October 2008 when I warned you that we are on our way down to 1.25.

Sure enough, by 23 November 2008, the Euro was already trading at 1.25 levels. Such is the power of this concept that those traders who seek out extended fifth waves as the only trades they will take should all be pretty rich!

Are you an emerging market buff? Then this chart of the Bombay Sensex should be revealing.

Extended wave 5 in India’s Sensex Index also presented profitable trading opportunities

What is the lesson here folks? Technical analysis can be used to considerable benefit. And there is no doubt that fifth wave extensions can make you rich. Yes, when it comes to pulling the trigger, we all are scared. (Honestly, I made money in only some of these recommendations because my stops were too close! And even then, I could not risk a very large sum. But those who had the staying power made millions. One of my clients saved over $7 million by shifting his GBP deposit into USD just before the collapse. But coming back to the average Joe (the plumber 🙂 or trader) we should definitely take small risks at the end of fifth wave extensions. Please bookmark this post and share with your friends. With best wishes. Ramki

What is the lesson here folks? Technical analysis can be used to considerable benefit. And there is no doubt that fifth wave extensions can make you rich. Yes, when it comes to pulling the trigger, we all are scared. (Honestly, I made money in only some of these recommendations because my stops were too close! And even then, I could not risk a very large sum. But those who had the staying power made millions. One of my clients saved over $7 million by shifting his GBP deposit into USD just before the collapse. But coming back to the average Joe (the plumber 🙂 or trader) we should definitely take small risks at the end of fifth wave extensions. Please bookmark this post and share with your friends. With best wishes. Ramki

Quick Question: Did you wish that you could learn directly from me on how to trade using Elliott Waves? Then you need not wait any longer. I have published what is now being acknowledged as the BEST course available online for traders