This article discusses Silver Outlook following an Extended Wave 5 being completed. It originally appeared in WaveTimes on 4 May 2011 and is linked to my Elliott Wave book, Five Waves to Financial Freedom. The learning experience remains relevant today, as it will be forever in the future.

What is the outlook for Silver?

In my prior Elliott Wave analysis of 24 April 2011, I had made the case for a test of the $50 level in Silver. At the time of writing this post, the precious metal has already reached $49.51. And oh boy! Whatever happened there is a trader’s nightmare, especially if he was caught with a long position. In just 4 days, Silver has lost over 18% of its value. This kind of move usually upsets the uninformed trader. Could this have been anticipated? What can we do from here? Where is Silver going in the medium term? Or simply put, what is the outlook for Silver? These questions are uppermost in the minds of traders. Let us address them one by one.

Could we have anticipated this selloff in Silver?

If you were using Elliott Wave Analysis, then you would have had anticipated a top near the $50 level without too much trouble. (We had actually done that in this blog).

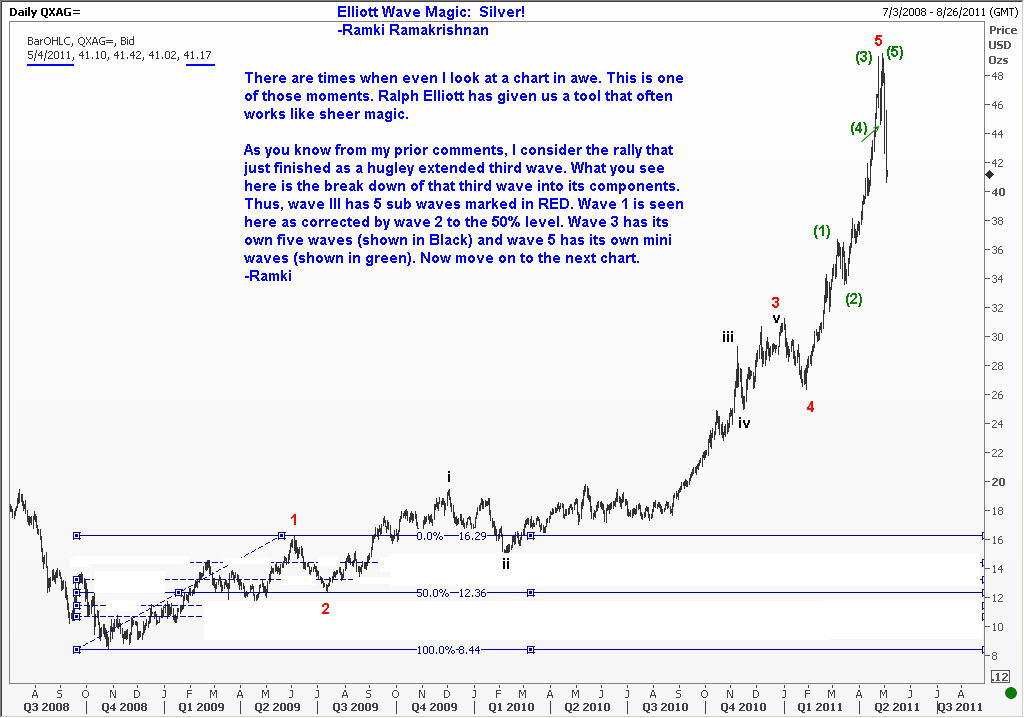

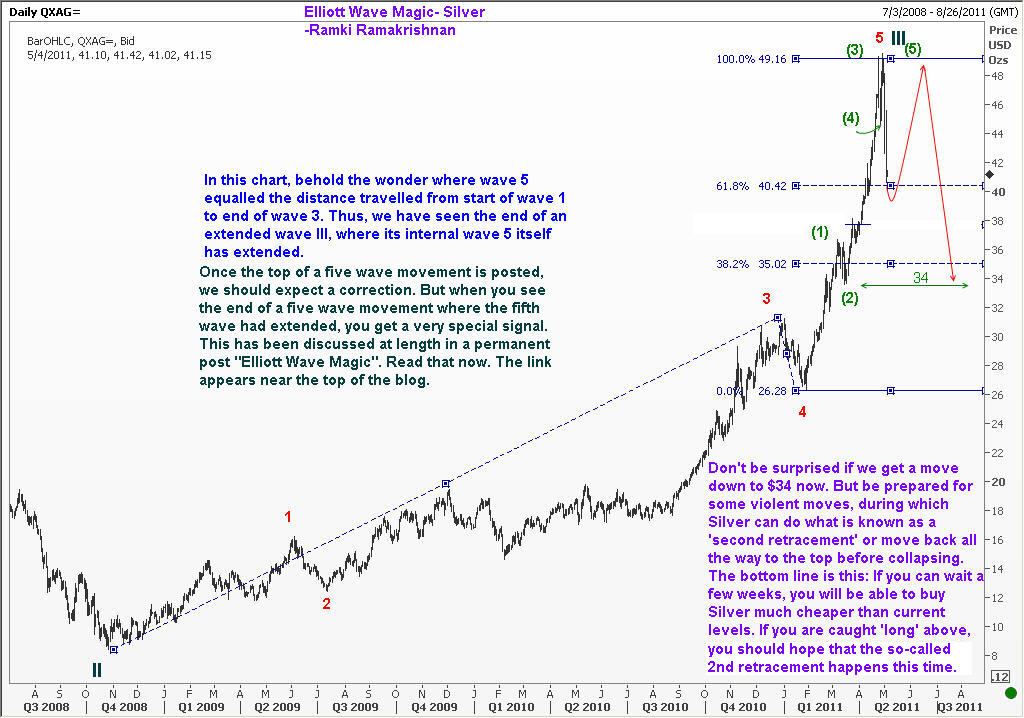

Look at the first two charts shown here. When the extended fifth wave covered a distance equal to the distance travelled by waves 1-3, any serious trader would think of taking profits. What is more important is the fact that any correction that follows the completion of an extended fifth wave is expected to be BOTH sharp and deep. This phenomenon has been covered extensively in this blog (see Fifth wave extensions can make you RICH!).

The next chart that helps us to determine the outlook for Silver has many interesting Elliott Wave Analysis features. Study it carefully for it will enhance your learning a great deal.

What can Silver traders do from here?

First of all, we should be prepared for a move down to the $34 level. That level is the 2nd wave of the extended fifth. Will we get there directly? This is not so easy to answer, but there are supports at 40.10 and 39.70. There is a reasonably good chance for a bounce from either of these levels, but lookout for selling to emerge again around 44.60. Only above 45.60 will I breathe easy if I was caught long above 49! Yes, it is that serious, buddy. There is always some hope that we will get the so-called 2nd retracement of the extended fifth wave, a move that can take us back to the top of the move before a collapse happens. But we cannot rest on hope. We need to manage any open positions with care. So, keep an eye on the resistances mentioned above.

What is the medium-term outlook for Silver?

As I said before, I am currently working on the paradigm that we have just finished a major wave III, and the anticipated dip to $34 area will be the wave IV. A new wave V rally will commence once this correction is finished. That rally might run out of steam near the $50 again if there are not enough reasons for the commodity run to continue. This blog will surely update you on how to trade that rally when it starts. For the time being, though, let us concentrate of navigating the down move to $34 without getting killed. The chart below shows you how I arrived at the outlook for Silver following extended wave 5 completion.

Final Thoughts

In this article, I have shown you how to determine the outlook for Silver at the end of an extended wave 5. I used Elliott Wave Analysis to help me make up my mind. It was possible to anticipate many of the turning points in Silver using a combination of Elliott Waves and Fibonacci Retracements. I have included a lot of useful learning comments in the three charts that appears above. If you liked the above, I am sure you will find that my online course, How to Profit from Elliott Waves, will take you to a much higher level of understanding and profitability. Welcome aboard!